Fama French 3 Factor Model Coefficients Interpretation

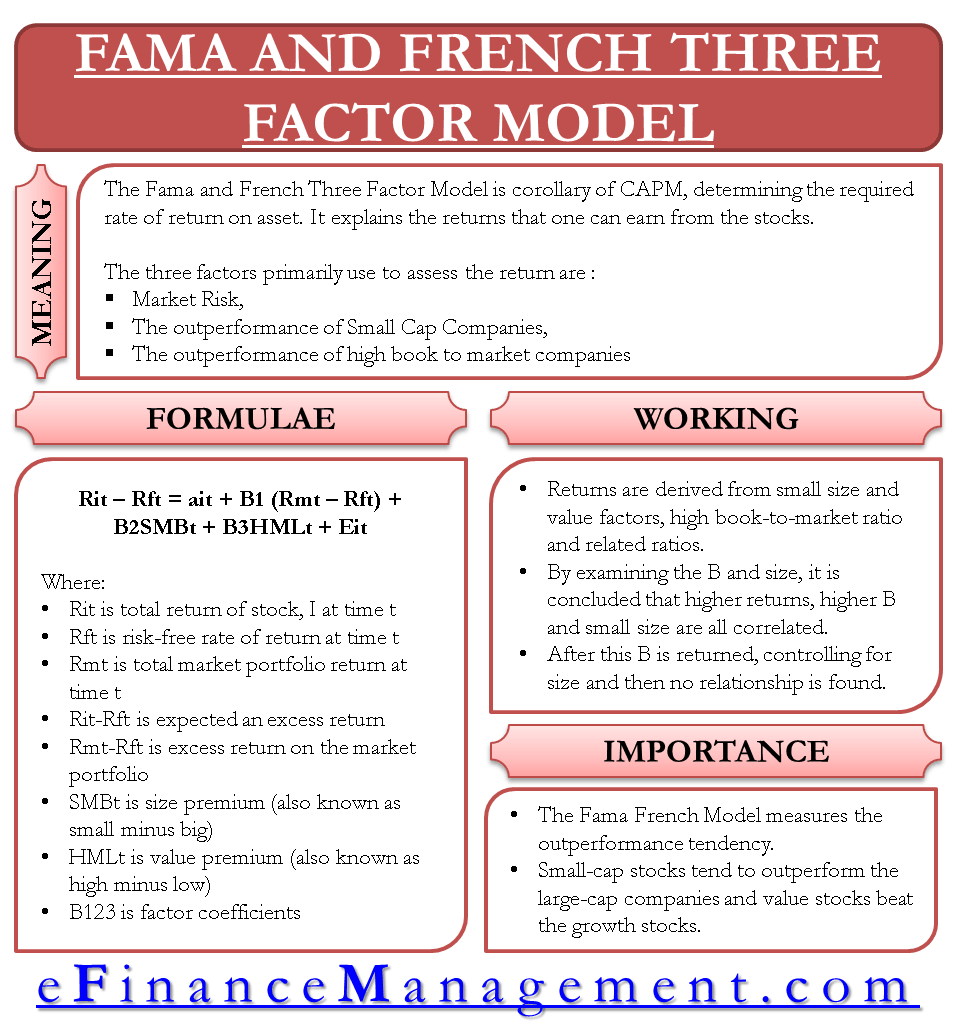

Rf is the risk-free rate the rate of return given by a zero-risk asset such as a Treasury bond or bill. R - R f beta 3 x K m - R f b s x SMB b v x HML alpha Here r is the portfolios return rate R f is the risk-free return rate and K m is the return of the whole stock market.

Fama French Three Factor Model Youtube

Small cap stocks categorized by small size and value stocks categorized with book to market ratios.

. The intercept of -002437 suggests that IWD under performed the regression benchmark. R i t total return of a stock or portfolio i at time t R f t risk free rate of return at time. Fama-French 3 Factor Model Extension of the Capital Asset Pricing Model CAPM CAPM Ra Rfr where Ra Return of the Asset Rfr Risk-Free Rate βa Beta Coefficient of the Asset Rm - Rfr Market Risk Premium Fama-French 3 Factor r rf β1rm - rf β2smh β3hml r Expected rate of return rf Risk-free rate ß Factors coefficient sensitivity rm rf Market.

Related and they are captured hy the three-factor model in Fama and French FF 1993. By adding these factors into the CAPM they were able to create a model that has incredibly strong performance. Since William Sharpes Capital Asset Pricing Model CAPM considers only market risk factor it was debated that there are other factors that can be attributed to the expected return of an asset or security.

When applying the Fama-French 3-Factor model you first run the linear regression. The FamaFrench three-factor model has become the standard academic tool for assessingportfoliosaswellasindividualstocksThethreefactorsare1amarketfactor RMRF2asizefactorSMBand3avaluefactorHMLThemodelisoftenused toidentifyexposuretothefactorstheportfoliosstyle1 Factorinvestinghasrecently. In asset pricing and portfolio management the FamaFrench three-factor model is a statistical model designed by Eugene Fama and Kenneth French to describe stock returns.

The model says that the expected return on a portfolio in excess of the risk-free rate Eij - Rj is explained by the sensitivity of its return to three factors. Return is the rate of return on your portfolio or investment being measured. This study mainly includes the analysis of the coefficients of the two models to evaluate which model has a higher explanatory power and determine the influence factors for the manufacturing industry and health industry.

Return Rf Ri SMB HML. The Fama-French 3 factor model explains IWD arithmetic returns very well with an adjusted R squared of 098273. United States en-US Germany de-DE Spain es-ES.

In two previous posts we calculated and then visualized the CAPM beta of a portfolio by fitting a simple linear model. R i t R f t α i t β 1 R M t R f t β 2 S M B t β 3 H M L t ϵ i t where. This study mainly includes the analysis of the coefficients of the two models to evaluate which model has a higher explanatory power and determine the influence factors for the manufacturing industry and.

I run a regression of the excess return of a company on the 5 Fama-French factors I obtained the beta coefficients but I am struggling to understand the meaning of my results. The second step is a cross-section regression for each t. The Fama-French model aims to describe stock returns through three factors.

Fama-French 5 factor model interpretation of coefficients. R i t α i β i M k t R f M k t R f t β i S M B S M B t β i H M L H M L t ϵ i t. Fama-French three-factor model.

In shorthand this model is expressed as. The mktrf estimate of 096151 represents the beta of the fund and shows that the fund slightly under reacts to market movements. The Fama-French Three Factor Model Formula.

Introduction to Fama French. Fama and French were colleagues at the University of Chicago Booth School of Business where Fama still works. I the excess return on.

To estimate the corresponding factor loadings. SMB and HML for July of year t to June of t1 include all NYSE AMEX and NASDAQ stocks for which we have market equity data for. 5-factor model will give different coefficients.

Today we move beyond CAPMs simple linear regression and explore the Fama French FF multi-factor model of equity riskreturn. Relative to large-cap companies and 3 the outperformance of high. The data for the Fama-French risk factors is available on Kenneth.

Along with the original three the new model adds the concept that companies reporting. Fama and Frenchs Five-Factor Model. This is no different in your case--a negative SMB coefficient indicates given your specified model that your portfolio is negatively exposed to the FF Size factor eg for a 1.

Table 3 about here Table 4 shows the regression results for the three-factor model equation 2. This is a quick tutorial on how to estimate the Fama-French 3 Factor Model FF3 in Excel. The intercept terms are almost the same as those estimated for.

Rm-Rf includes all NYSE AMEX and NASDAQ firms. The three factor beta is analogous to the classical beta but not equal to it since there are now two additional factors to do some of the work. The Fama-French 3 factor model started with the observation that two types of stocks tend to better than the market as a whole.

Fama French 3 Factor Model. Fama French three-factor and Fama French five-factor models are important models for explaining stock returns and finding risk factors. Fama French three-factor and Fama French five-factor models are important models for explaining stock returns and finding risk factors.

This study tested the three factor model of Fama and French 1993 using the Nairobi Securities Exchange NSE data using excess returns of. Ask Question Asked 3 years 1 month ago. Fama-French 5 factor model interpretation of coefficients.

See Fama and French 1993 Common Risk Factors in the Returns on Stocks and Bonds Journal of Financial Economics for a complete description of the factor returns. In 2014 Fama and French updated their model to include five factors. 1 market risk 2 the outperformance of small-cap companies Small Cap Stock A small cap stock is a stock of a publicly traded company whose market capitalization ranges from 300 million to approximately 2 billion.

In 2013 Fama shared the Nobel Memorial Prize in Economic Sciences for his empirical analysis. Fama-French developed a 3 factor model which incorporated size and value factors along with market risk factor.

Regression Results From The Fama French Three Factor Model Download Table

Performance Measures And Factor Coefficients Under Fama French 3 Factor Download Scientific Diagram

No comments for "Fama French 3 Factor Model Coefficients Interpretation"

Post a Comment